Getting The Hsmb Advisory Llc To Work

Wiki Article

Everything about Hsmb Advisory Llc

Table of ContentsSome Ideas on Hsmb Advisory Llc You Should Know7 Easy Facts About Hsmb Advisory Llc ShownHsmb Advisory Llc - The FactsSee This Report about Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Do?Rumored Buzz on Hsmb Advisory Llc

Ford says to guide clear of "cash money value or long-term" life insurance policy, which is even more of an investment than an insurance policy. "Those are really made complex, included high commissions, and 9 out of 10 people don't need them. They're oversold due to the fact that insurance representatives make the largest payments on these," he claims.

Disability insurance can be costly. And for those who decide for long-term care insurance coverage, this plan might make handicap insurance unneeded.

Some Known Details About Hsmb Advisory Llc

If you have a chronic health and wellness problem, this kind of insurance might finish up being important (Insurance Advisors). Nonetheless, do not allow it emphasize you or your checking account early in lifeit's generally best to secure a plan in your 50s or 60s with the expectancy that you won't be using it up until your 70s or later.If you're a small-business proprietor, take into consideration protecting your livelihood by acquiring organization insurance policy. In the event of a disaster-related closure or duration of restoring, company insurance can cover your income loss. Take into consideration if a substantial weather condition event influenced your store or production facilityhow would certainly that impact your revenue? And for how long? According to a record by FEMA, in between 4060% of little companies never ever resume their doors complying with a catastrophe.

And also, making use of insurance can occasionally set you back even more than it conserves in the long run. If you obtain a chip in your windshield, you may consider covering the fixing cost with your emergency savings instead of your vehicle insurance policy. Why? Since using your auto insurance policy can trigger your monthly costs to increase.

All About Hsmb Advisory Llc

Share these tips to safeguard enjoyed ones from being both underinsured and overinsuredand talk to a trusted expert when needed. (https://www.pubpub.org/user/hunter-black)Insurance that is acquired by a private for single-person insurance coverage or coverage of a household. The individual pays the premium, in contrast to employer-based health and wellness insurance policy where the employer typically pays a share of the costs. Individuals might purchase and purchase insurance coverage from any kind of plans offered in the person's geographic region.

People and families may qualify for monetary assistance to reduce the price of insurance premiums and out-of-pocket expenses, however just when enrolling with Link for Wellness Colorado. If you experience certain adjustments in your life,, you are qualified for a 60-day time period where you can register in a private strategy, also if it is beyond the yearly open enrollment duration of Nov.

The Ultimate Guide To Hsmb Advisory Llc

- Connect for Health Colorado has a complete checklist of these Qualifying Life Occasions. Dependent children who are under age 26 are qualified to be consisted of as relative under a parent's coverage.

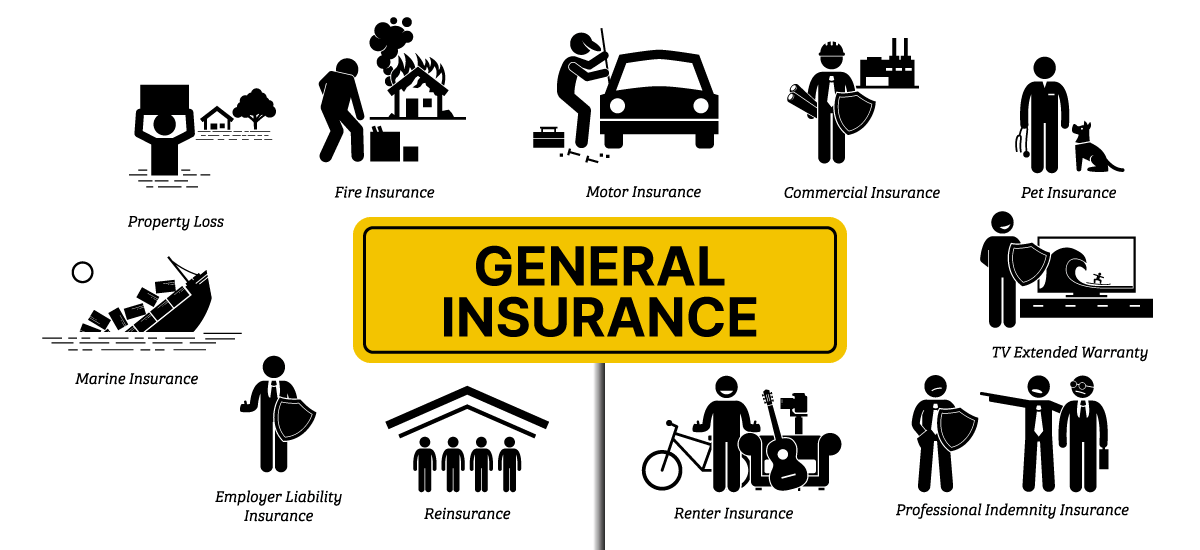

It might appear straightforward but understanding insurance policy kinds can likewise be puzzling. Much of this confusion originates from the insurance policy market's ongoing objective to create individualized protection for insurance policy holders. In designing adaptable plans, there are a variety to pick fromand every one of those insurance coverage types can make it challenging to comprehend what a specific policy is and does.

What Does Hsmb Advisory Llc Mean?

The very best place to start is to talk regarding the difference between both kinds of fundamental life insurance: term life insurance policy and long-term life insurance policy. Term life insurance policy is life insurance coverage that is only active for a time duration. discover this info here If you pass away during this duration, the person or people you have actually named as beneficiaries may get the cash payment of the plan.

Nonetheless, lots of term life insurance policy plans allow you transform them to an entire life insurance policy, so you don't shed protection. Normally, term life insurance policy premium settlements (what you pay monthly or year right into your policy) are not secured at the time of purchase, so every five or ten years you possess the policy, your premiums can rise.

They also often tend to be cheaper total than entire life, unless you purchase an entire life insurance plan when you're young. There are also a couple of variants on term life insurance policy. One, called group term life insurance policy, is common amongst insurance choices you may have accessibility to with your employer.

What Does Hsmb Advisory Llc Mean?

This is generally done at no price to the employee, with the ability to acquire added coverage that's gotten of the staff member's paycheck. One more variation that you may have accessibility to via your employer is extra life insurance policy (Insurance Advise). Supplemental life insurance policy might include accidental fatality and dismemberment (AD&D) insurance, or funeral insuranceadditional insurance coverage that could aid your household in instance something unforeseen occurs to you.

Long-term life insurance policy simply refers to any type of life insurance coverage plan that does not run out.

Report this wiki page